Bull vs Bear

An explanation of the difference between a Bull and Bear run.

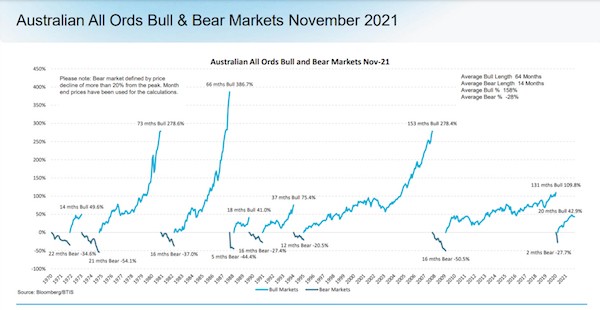

The terms ‘Bull’ market and ‘Bear’ market are always in the news and most know what they

mean, though a brief definition is noted below. The point of this chart is to allow us to see

more detail on Bull and Bear periods in regard to the Australian All Ords since 1970. A

quick snapshot, but interesting.

What is a bull market?

A market is referred to as a ‘bull’ market when the share market is showing confidence. It is

essentially a market in which share prices continue to rise, encouraging buying. After a

sustained period of increasing share prices, investors gain faith that the uptrend will continue

in the long-term. In a typical bull-market, the country’s economy is strong and

unemployment is low.

A market may be called a bull market after a number of ‘bullish’ days in succession, but the

technical criteria for a bull market is a rise in the value of the market by 20%.

What is a bear market?

‘Bear’ markets are the opposite of bull markets, and while there’s no hard and fast rule, the

generally-accepted definition is that they occur when the markets fall by more than 20%. In

bear markets, the prices of securities are falling, and widespread pessimism among investors

caused by the falling prices leads to self-sustaining negative sentiment.